Payday HCM vs. Quickbooks: Comparing HR & Payroll Services, Pricing

April 8th, 2025 | 5 min. read

Nowadays, it would seem that the world is built on comparisons. We could all probably spend countless hours scrolling through different websites, online shops, and articles talking about the best set of these or the top ones of that—it’s no different when it comes to deciding on certain services for your business. And this seemingly infinite amount of information comparing a vast amount of service providers to each other can be extremely valuable for business owners looking to make a careful, informed decision. In that same breath, however, the vast possibilities of the world wide web can also be overwhelming. You may find yourself spinning in your office chair from the sheer volume of options available to you—and this is before you actually have to narrow down your choices and eventually make a decision.

The internet being simultaneously helpful and overwhelming isn’t exactly news, but it’s still a problem that almost all of us face, business owners and individuals alike. At Payday HCM (and probably at any business), we’ve had plenty of potential clients ask, “What makes you better than so and so?” It’s a good question and one that can be hard to ensure whoever is aksing feels like they’ve gotten a thorough—and unbiased—answer. Everyone should have access to resources that will help them make the most informed decision for their business, and an important part of doing that is having access to just the facts.

That’s why, in this article, we’ll be comparing our services to those of one of our competitors—QuickBooks—to see how our and their services stack up against each other. We’ll go over four different facets of both companies’ services:

By the end of this article, you’ll have both a better understanding of the services provided by both companies and the knowledge you’ll need to make the best decision for your business.

Payday HCM vs. QuickBooks: Payroll Services

First and foremost, we’ll go over how Payday’s and QuickBooks’ payroll services compare to one another.

QuickBooks: Automated Payroll Solutions

Outsourcing your payroll can be a big decision: you want to take the load of running payroll off of either yourself or someone else at your organization, but you still want to ensure you have broad control over the process. With QuickBooks, you can achieve both with an automated payroll solution that still leaves the control in your hands.

QuickBooks offers a one-size-fits-all automated software solution for businesses looking to streamline their payroll process. Automatic tax filing, automated payroll, time tracking and payroll integration, and an in-house workforce app all help you speed up your payroll processes while ensuring you’re still the one in charge.

Payday HCM: Payroll People

For some businesses, outsourcing payroll is all about trust: finding the right people and the right provider that you trust to fully handle your payroll. With Payday HCM, you’ll find just that: an all-encompassing payroll solution that takes the weight of payroll off your hands, helping you focus on the other tasks at hand.

When it comes to services, Payday offers a suite of options when it comes to payroll, taxes, time tracking, and scheduling. This is all packed into the capable isolved software. You’ll also have access to the dedicated team at Payday, providing you with a people-centered approach to running your business’s payroll.

Payday HCM vs. QuickBooks: HR And Benefits Services

On top of payroll services, both Payday and QuickBooks offer HR and benefits administration as well—we compare them here.

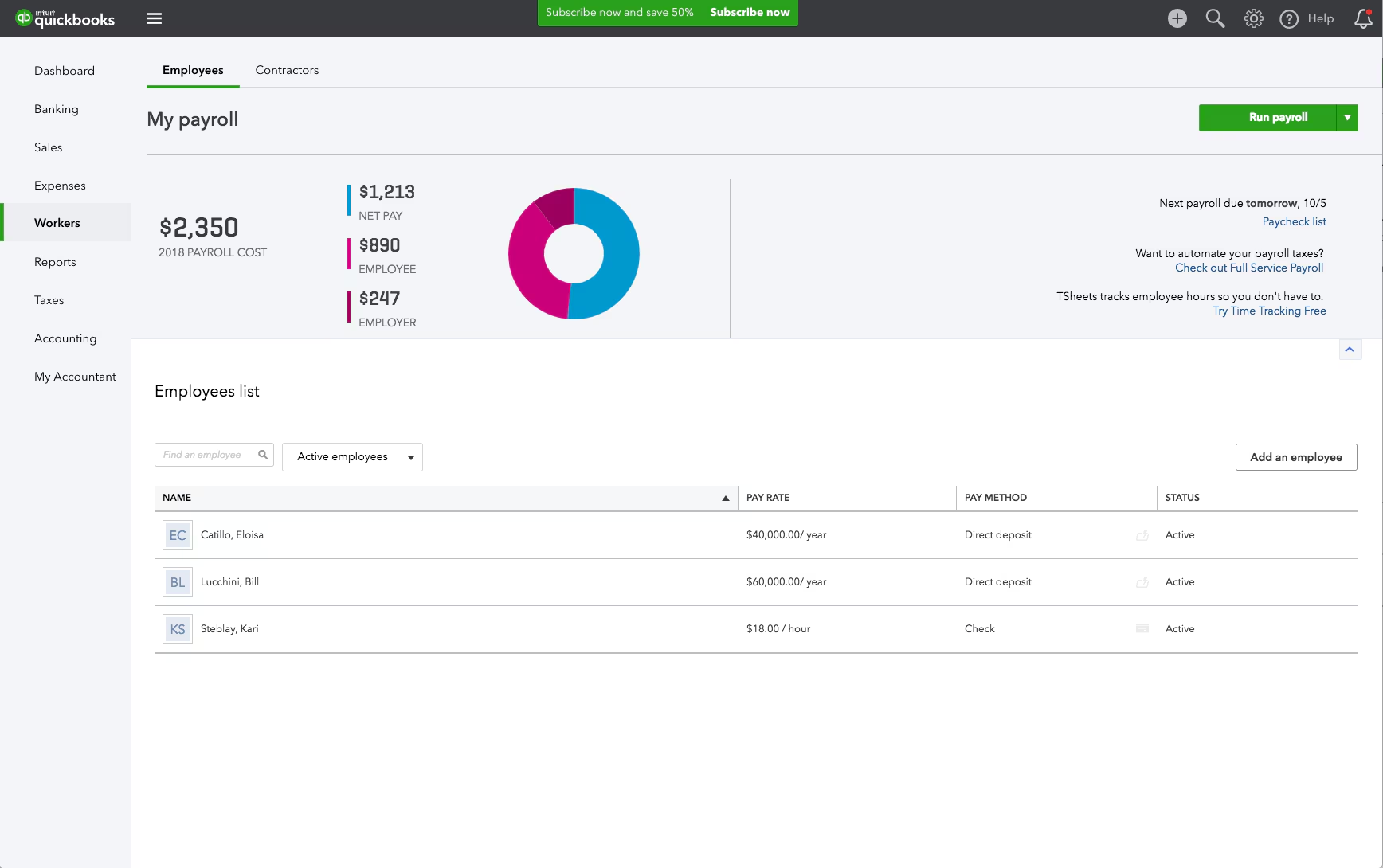

The QuickBooks payroll software. Image courtesy of QuickBooks.

QuickBooks: Integrated HR And Benefits Solution

While QuickBooks largely prides itself on its payroll and accounting software, helping your business make smart money decisions, it also offers HR and benefits solutions through a few third-party partners. This gives your business a more comprehensive all-in-one solution that still provides a level of customizability in cases where you may want some services but not others.

QuickBooks has partnered with Mineral Inc. to offer an HR solution that integrates with their payroll platform. This allows you to manage things like payroll as well as hiring and onboarding through one platform. They offer a similar approach to benefits, partnering with companies like Allstate, Guideline, and Next for health insurance, 401(k), and workers’ comp management, respectively.

Payday HCM: Human-First HR And Benefits Solutions

Payday offers an all-in-one approach to payroll, HR, and benefits administration, providing your business with the ability to manage all three through one software platform. Like QuickBooks, Payday allows you to select which services you want and don’t want, ensuring a unique solution built specifically for your business.

With both Payday’s benefits and HR solutions, you’ll have access to dedicated teams that will help you manage your employees’ benefits (health insurance, 401(k), PTO, wellness programs, etc.) as well as your HR operations. This includes things like hiring and onboarding as well as consultation and training and development programs.

Payday HCM vs. QuickBooks: Customer Support And Experience

Even with a great payroll solution, problems are bound to occur. Dive into the differences between Payday’s and QuickBooks’ customer support services.

QuickBooks: 24/7 Online Support And Resource Hub

On top of their live bookkeeping services, QuickBooks maintains an around-the-clock customer service team to help assist with any problems that may arise, even during the off-hours. This ensures you’ll have access to the answers you need when you need them.

On top of this, QuickBooks maintains a robust online support hub, helping empower businesses to solve problems on their own as they arise. Their support center includes things like video tutorials, blog articles, and a community Q&A board where other QuickBooks clients can help assist each other with any issues they may have.

Payday HCM: Dedicated Customer Service Representatives

Starting with that first phone call all the way through the integration process, you’ll work with a knowledgeable team of individuals at Payday to ensure every step of the process is as smooth as possible. This continues once you’re a full-fledged client: Payday retains a full team of customer service representatives ready to assist your business with any questions or concerns.

With Payday, you’ll receive a dedicated customer service representative, ensuring not only that you’ll receive the help you’re looking for but that you’ll also know exactly who to ask. Payday’s team prides itself on responsiveness, ensuring you’ll never be left hanging when a problem arises.

Payday HCM vs. QuickBooks: Pricing

The moment you’ve all been waiting for. At the end of the day, it all comes down to pricing. Let’s break down how Payday’s and QuickBooks’ pricing compare.

QuickBooks: Affordable Automated HR & Payroll Solutions

For smaller to mid-size businesses looking for an automated payroll solution that doesn’t break the bank, QuickBooks is a great option. They’ll have all the tools you’ll need to get your business off the ground and help you focus on what matters.

QuickBooks’ pricing operates in tiers, with the lowest tier option for payroll starting at $42.50 a month for the first three months, after which it becomes $85 a month (plus $6 per employee). Their base plan includes their payroll software as well as their bookkeeping services and benefits administration. The highest tier, priced at $92 a month for the first three months and $9 per employee, also includes these plus HR support.

Payday HCM: Payroll Priced For Your Needs

For businesses of any size looking for a solution that fits their needs—whether that be payroll, benefits, HR, or all three—Payday offers a pricing plan that’s built for you. Whether you’ve outsourced before or you’re just getting started, Payday has a solution that will help empower your business.

Payday’s pricing is tiered similarly to QuickBooks: the lowest tier for 50 employees or less starts at $110 a month plus $7.20 per employee per month. For businesses with 50 employees or more, the lowest-tiered plan starts at $12.60 per employee per month. For benefits and HR services, reach out to our sales team for a precise price breakdown for your business.

Find The Right Fit For Your Business

Finding the right payroll, HR, or benefits provider isn’t as simple as some other choices you’ll have to make. Considering the almost endless number of options available to you (and the endless amount of resources dedicated to selling you on one of these options), it can be overwhelming as a business owner to come to an informed decision on what’s a best fit for your business. Ensuring this decision is the right one is crucial—there’s not a large margin of error when it comes to people’s paychecks or their health insurance. With the information provided in this article, we hope you’ll be able to approach the decision-making process a bit more confidently and rest assured that you’ve made the right choice for your business.

As we’ve said time and time again throughout this article, choosing the right payroll provider is one of the most important steps your business can take. And, maybe, just maybe, after everything you’ve read, Payday HCM sounds pretty good. Learn more about Payday HCM’s payroll services to find out if we’re the right fit for your organization.

Patrick has worked for Payday HCM since 2012, with a career that has spanned multiple responsibilities in the sales arena. He now maintains a 300+ client portfolio with a 98% retention rate. Patrick works diligently to determine the optimal utilization of our software, manages ongoing quality assurance, and brings best practices to Payday HCM’s clients. Patrick graduated with a Bachelor's in Business Administration, with a concentration in Finance, from the Anderson School of Management at the University of New Mexico. Having spent the decade since graduating meeting and partnering with entrepreneurs throughout New Mexico, Patrick firmly believes Payday HCM brings national Fortune-500 level service and technology to the New Mexico marketplace.

Topics: