What to Do if You Are Not in Compliance With the ACA

August 16th, 2023 | 3 min. read

Staying in compliance with government regulations can be a difficult task for business owners and managers. There is so much to know on the state and federal levels that it can seem overwhelming and time-consuming. One such regulation is the Affordable Care Act, commonly referred to as the ACA or Obamacare.

At PaydayHCM, we are experts in compliance and implementing solutions to help businesses become compliant with the applicable laws and regulations. We were doing business decades before the ACA and for more than 20 years after. We know the ins and outs of complying with laws and we help our clients every day with these kinds of issues.

Although this article covers the ACA only, the principles and methods that we suggest for compliance with this regulation can be applied to others and can help you have a better understanding of how to approach future regulations that will be put in place.

Below you will learm:

- What Is the ACA and Why Does It Matter?

- How Do I Comply With the ACA?

- ACA Compliance Can Help With Employee Retention

What Is the ACA and Why Does It Matter?

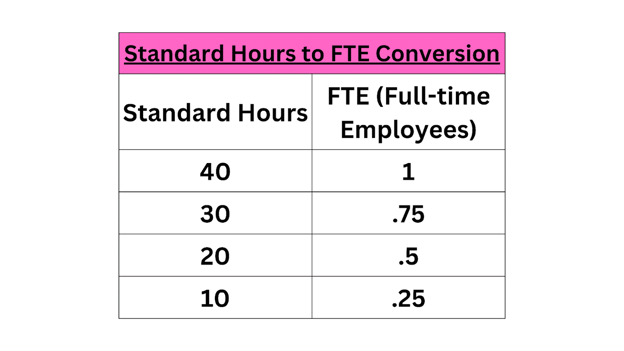

The ACA is the Affordable Care Act. It has been in place now for more than two decades. The ACA applies to an organization with 50 or more full-time equivalent employees. What is “full-time equivalent” or FTE? It’s a simple calculation that will help you know how many full-time employees you technically have.

Now, if you do the calculations and realize that you have 50 or more employees, then you must offer an affordable health plan. What is an affordable health plan? According to healthcare.gov, “a health plan is considered affordable if the employee’s share of the monthly premium in the lowest-cost plan offered by the employer is less than 9.12% of [their] household income.”

There are also what are known as “safe harbors.” These help employers figure out if their insurance offering is considered affordable. Because most employers don’t know their employee’s household incomes, they can use the W-2, Rate of pay or Federal Poverty Line. Each method uses a different formula and data for calculating affordability.

How Do I Comply With the ACA?

To comply with the ACA, you must follow the previously mentioned guidelines for 95% of your employees. You must also provide year-end reporting to the IRS to document this. You are required to submit forms 1094-C and 1095-C. If you are using any of the safe harbor methods that we mentioned, you must report this on 1095-C.

Failure to comply with the ACA results in penalties. An employer will be penalized according to the A Penalty, which is $2,970 per FTE (remember your FTE calculations), minus the first 30 employees. This penalty comes if an employer fails to offer (or fails to show that they offered) minimum essential coverage to 95% of its full-time employees and their dependents. Penalties can go up from there and as you can tell, they add up quickly.

Some have asked us if it might be a good option to simply pay the penalties if they seem to be less than the cost of coverage. We advise against this approach because it is risky and can lead to unforeseen consequences, such as additional penalties. Penalties increase when companies willfully fail to provide information. It’s just not a road you want to go down.

ACA Compliance Can Help With Employee Retention

So, what if you are not required to comply with the ACA? Maybe you have 40 full-time employees. We still recommend that you are familiar with the requirements and that you implement them if possible. This is a good idea for a couple of reasons.

First, it ensures that if growth takes place in your organization, especially rapid growth, you will be prepared to implement all of the laws and regulations that apply to your new number of employees. In addition, there are still steps you have to take, if you are going to voluntarily offer health coverage for a small business. You will need to provide each employee with the Notice of Marketplace Coverage Options.

Second, whether you are required to or not, a good health insurance plan is extremely desirable and can help you attract and retain the best employees for your organization. This will require you to look at your organization’s budget, the company culture, turnover and retention rates, and what others are offering in your industry.

You will also want to make sure your employees are well-informed about what offerings are available to them. They should be aware of the plan design, cost, how to use the plan, and which providers are in network. They should know enough to be comfortable deciding whether to enroll or waive the coverage.

Learning the ACA Takes Time and Patience

There is a lot that goes into learning and complying with the ACA, but it is something you can achieve by collecting data and information about your organization.You can then use that information to choose a path forward.

Begin by determining how many FTEs you have and what their needs are. If you have 50+, then you need to prioritize coverage immediately to come into compliance with the law. If you have less than that, you are not subject to the full ACA but there are still some minor requirements.

We’ve been helping companies with compliance at PaydayHCM, well before the ACA came along and we’ll be here well after, providing guidance and information on future regulations and laws that will affect you. If you have more questions, you can always contact one of our living, breathing human experts.

We have plenty more knowledge for you about setting up benefits for your organization. Give 6 Steps to Develop and Implement a Company Health Plan a read and discover a simple way to get started.

Keith Edwards is a graduate of the United States Military Academy at West Point and a former U.S. Army Captain. He has over 34 years of leadership experience in government, financial services, manufacturing, retail, and non-profit organizations. He assists businesses in improving the bottom line through increased efficiency in payroll processing, time and attendance, employee benefits, and human resources. His goal is to allow your business to focus on revenue-producing activities instead of non-revenue-producing activities to allow business leaders to sleep better at night knowing they are protected from threats related to compliance and tax/financial issues in the areas of payroll and HR.

Topics: